dreams into thriving businesses. If you’re ready to enter the tax industry or elevate your current practice,

you’ve come to the right place. Our mission is to make your journey not only easier but exhilaratingly successful.

TAX PRO STARTUP BUNDLE

Stop wasting time and money trying to figure out how to launch a tax business on your own. The Tax Pro Startup Bundle isn’t just a package—it’s your complete business in a box, giving you everything you need to start strong and grow fast without wasting money. Avoid costly mistakes, keep your profits, and focus on building the tax business you’ve always dreamed of. Get started today and make every dollar count!

Why This All-in-One Solution Saves You Time and Money:

- No Wasted Money on Guesswork: Receive EFIN/PTIN filing guidance to avoid delays

- No Hidden Costs or Ongoing Fees: Includes lifetime tax software, ASFP 18-unit CE course, and 30 hours of virtual assistant help for marketing/ social media and more.

- Maximize Your Earnings from Day One: Keep 100% of your profits with no splits,

- Launch Quickly Without Overhead: Get live business training, compliance support, and setup assistance to save time and cut overhead costs

- Work Smarter, Not Harder: Use your branded mobile app, custom intake forms and 30 hours of virtual assistance—no extra hiring

TAX PRO GROWTH PACKAGE

This package is designed for seasoned tax professionals

Are you tired of splitting revenue, paying high fees, or figuring out how to scale your tax business on your own, the Tax Pro Growth Package is your complete solution. Designed for experienced tax pros ready to grow, streamline, and boost profits—no revenue splits. With our all-in-one system, you’ll get the blueprint- and education- for building a sustainable, profitable business while avoiding the costly mistakes that drain time and revenue.

Why This All-in-One Solution Helps You Grow Without Extra Costs:

- No More Revenue Splits: Keep 100% of what you earn—this package ensures all profits stay with

- Minimize Costs with Free Software: Our lifetime tax filing software saves you thousands in annual fees and

- Expert Guidance at Every Step: Receive EFIN/PTIN filing assistance, tax return support, and due-diligence training to run your business with

- Save Time and Boost Efficiency: Get 30 hours of virtual assistant support included, with low-cost retention options to keep your operations running

- Take Your Business to the Next Level: Self- paced courses, live Zoom trainings, and the ASFP- 18 hr CE course Stay ahead of industry trends.

SOFTWARE SOLUTIONS

Are you tired of overpriced software, hidden fees, and limited functionality holding your business back? Our Software Solutions Package offers everything you need to manage your tax operations efficiently—without breaking the bank. Whether you’re filing returns for a few clients or managing a large-scale tax practice, this all-in-one package provides powerful cloud-based software, full support, and maximum flexibility. At just $499 (or less with volume pricing), this package ensures that you get enterprise-level tools and support without the high cost.

Why Our Software Package Helps You Save and Grow:

- No Hidden Fees or Limits: With unlimited users and filings included, there’s no need to worry about extra costs as your business

- Scalable for Every Business Size: Whether you’re solo or managing a team, our cloud-based software adapts to your needs with

- Full Multi-State Filing Support: Prepare tax returns for all 50 states without paying additional fees or buying

- Stay Focused with Expert Support: Even though it’s software, you’re never on your own—our team is here to help every step of the

- Maximize Efficiency: Cloud-based access gives you and your team the ability to work from anywhere, ensuring flexibility and seamless

CLASSES

Online Lessons: Quick, easy-to-understand guides on starting a tax business, preparing taxes, and using tax software.

Live Classes: Expert-led sessions on running and marketing your tax business.

CE Classes:Stay compliant and updated with continuing education units.

ADVANCED SOFTWARE SOLUTIONS

Free Lifetime Software: Cutting-edge tax software with unlimited software support (with only a $75 renewal fee).

TAILORED BUSINESS PARTNERSHIPS

ERO Solutions: Comprehensive support for tax businesses with an EFIN. (NO SPLIT)

Partnership Program: Resources to help tax businesses obtain an Electronic Filing Identification Number (EFIN) with the IRS. Support to help you start your tax business the right way. (NO SPLIT)

Service Bureau Package:

#OURBUSINESSISGROWINGYOURS

“WHY CHOOSE US”

#OURBUSINESSISGROWINGYOURS

What We Do

In addition, we offer the following:

- Professional Tax Software

- Tax Training

- Tax Education

- Office set-up assistance

- Tax Preparation Support (Optional)

- Unlimited-User & Site setup

- Marketing Strategies

- Compliance Support (Optional)

- Revenue Opportunity

- YOUR OWN VIRTUAL ASSISTANT

THRIVING PARTNERSHIPS

With ATP’s Turnkey Business Packages, everything you need is at your fingertips—startup classes, CE units, self-paced courses, software, tax help, and more. Say goodbye to endless research and guesswork. We’re here to help you maximize earnings and simplify your life. Join us now and take control of your financial future!

#OURBUSINESSISGROWINGYOURS

What We Do

In addition, we offer the following:

- Professional Tax Software

- Tax Training

- Tax Education

- Office set-up assistance

- Unlimited-User & Site setup

- Marketing Strategies

- Tax Preparation Support (Optional)

- Compliance Support (Optional)

COURSEs CATALOG

EVERYTHING YOU NEED TO KNOW TO START YOUR TAX BUSINESS FROM A-Z

MASTERING MONEY MINDSET

ACCURATE TAX PRO ONLINE

FAST-TRACK TAX PREP COURSE

BUSINESS ETHICS & COMPLIANCE

CE UNITS

CE UNITS

PRO SOLUTIONS & PRICING

Revenue Opportunities

- Sign-on Bonus – vacation package

- Identity Protection Bonus

- Audit Protection Bonus

- Bank Product Bonus

- Referrals – 25% of the sign-up fee

FREQUENTLY ASKED QUESTIONS

You can apply for a PTIN online through the IRS website. The process takes about 15 minutes and involves providing personal information, answering questions, and paying a fee.

TAX PRO RESOURCES

TAX PRO ADVISORY CENTER & FINANCIAL CALCULATORS

IRS PUBLICATIONS

PREPARER DUE-DILIGENCE

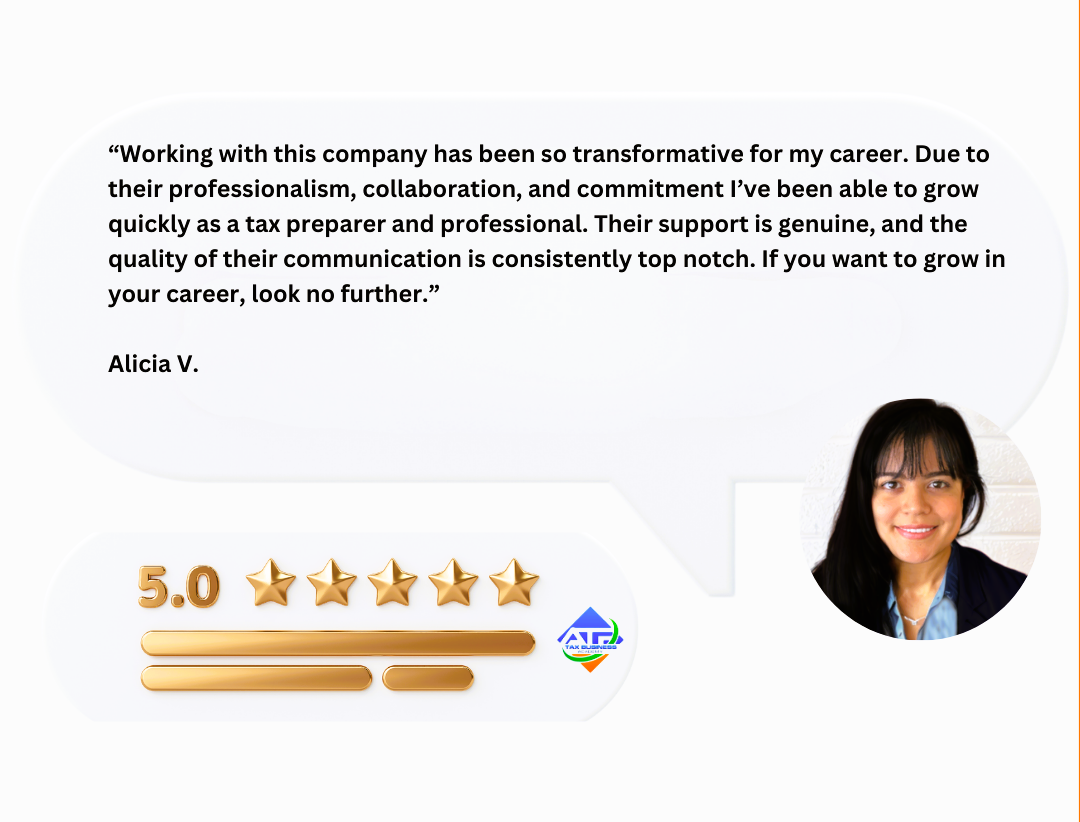

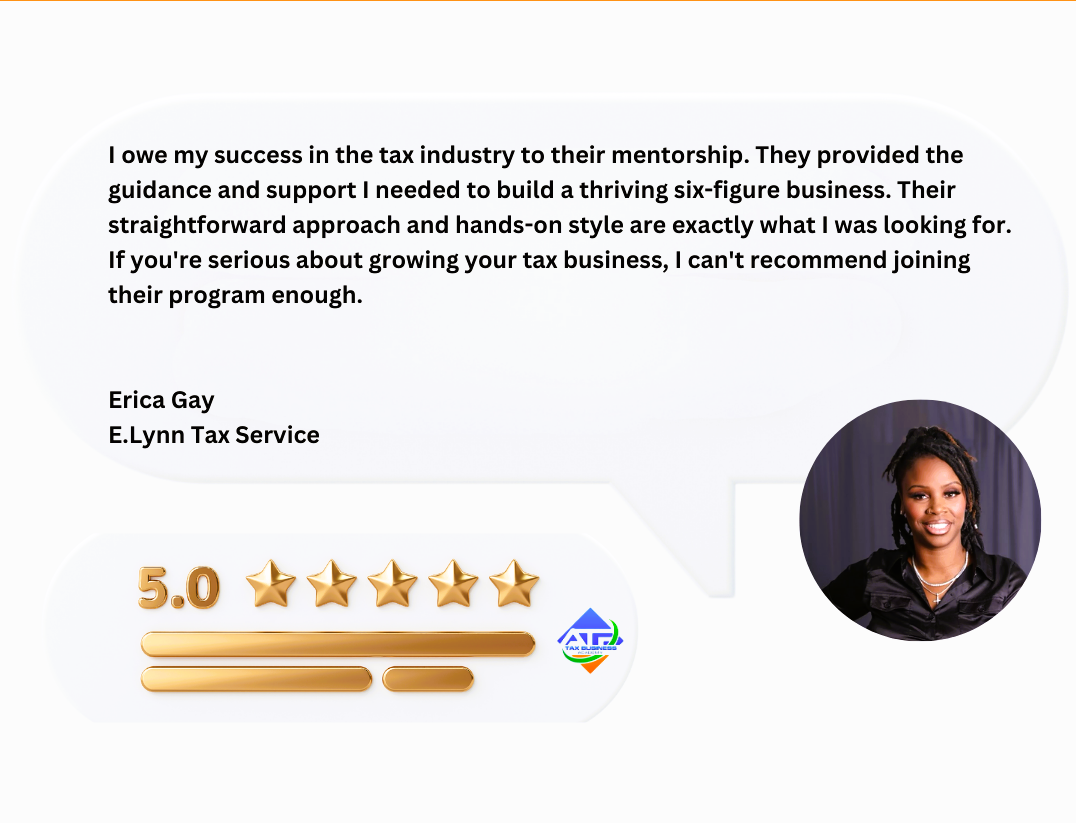

Partner Testimonials

free consultation

contact info

address

4879 Rockbridge Rd B2, Stone Mountain, GA

phone

(678) 536-1324

Info@atptaxbusinessacademy.com